Meet Streamlined Energy & Carbon Reporting requirements and make a difference to climate change

Streamlined Energy and Carbon Reporting (SECR) was introduced in 2019, as legislation to replace the Carbon Reduction Commitment (CRC) Scheme. It was implemented to improve visibility of carbon reporting and encourage energy efficiency in businesses, providing both economic and environmental benefits, supporting companies reduce their costs and improve efficiencies.

The requirements

SECR requires obligated companies to;

- report on their energy consumption and associated greenhouse gas emissions annually within their financial accounts for Companies House.

- report on any energy efficiency measures and emissions with reference to an intensity metric, e.g. tonnes of co2e/£m sales revenue.

Businesses successfully meeting SECR obligations all feed into this collective effort to decarbonise the UK power system, driving the change required to reduce effects of climate change.

Are you obligated for SECR?

SECR applies to all quoted companies, large limited liability partnerships and large UK incorporated unquoted companies*. Limited liability partnerships and UK incorporated quoted companies are considered to be large and must comply with the legislation if they meet two or more of the qualification criteria below:

- 250 or more employees

- Turnover in excess of £36 million

- Balance sheet in excess of £18 million

* Organisations using less than 40,000 kWh per annum will not be required to report

Request our complete SECR guide!

Our comprehensive guide provides all the key information you need to know about SECR legislation in one place, and defines the steps obligated companies need to take to become compliant.

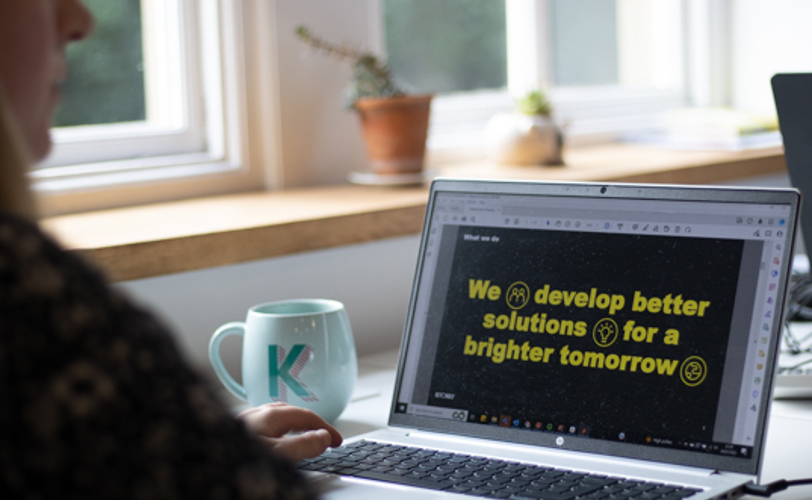

How does Beyondly deliver full complaince management?

1. Confirmation of obligation

2. Data collection

3. Energy reporting and emissions quantification

4. Preparation of annual SECR report and supporting analysis of energy consumption and emissions

5. Provision of audit support if required

Training and verification support also available!

Close quiz

Find out where to start

0% Complete!