Q1 2023 Unverified Packaging Data Released

This information is still unverified with a number of reprocessors/exporters to report their figures, so these volumes will have chance to evolve before release of the verified version next month (12th May).

The data for Q1, despite being unverified at this stage, is always highly anticipated before its release due to a lack of information preceding it. It is the first opportunity to take a detailed look into how packaging recycling is performing and holds the potential to make a significant impact in the respective PRN markets, depending on what the figures show.

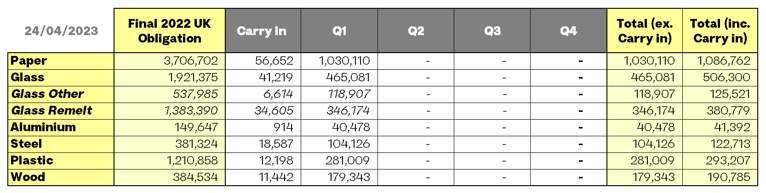

Table 1: 2023 packaging recycling levels alongside confirmed carry in and an estimated UK obligation.

The UK obligation, consisting of all producers final packaging submissions and using the recycling targets set for 2023 by DEFRA, will determine how many PRNs are required to be purchased in 2023. Currently, this UK obligation figure is not available (until 12th May), meaning it is difficult to accurately track the progress of the Q1 recycling levels against the UKs final goal.

To provide a performance benchmark at this stage, we have used an estimated obligation, which outlines the final packaging activity of all UK producers in 2022 as well as the 2023 recycling targets. However, the UK obligation is affected by more than just the recycling targets. The behaviours and attitudes towards packaging use in the 2022 calendar year will also impact how the demand for PRNs will change. Therefore, the final figures may present a slightly different picture, however these figures are still useful as we are able to see how well each material is potentially tracking against its recycling target at this early stage.

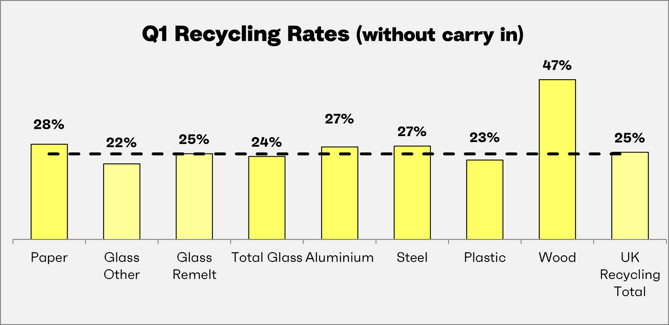

Figure 1.1: Q1 2023 unverified packaging recycling levels without carry over PRNs from December 2022 included.

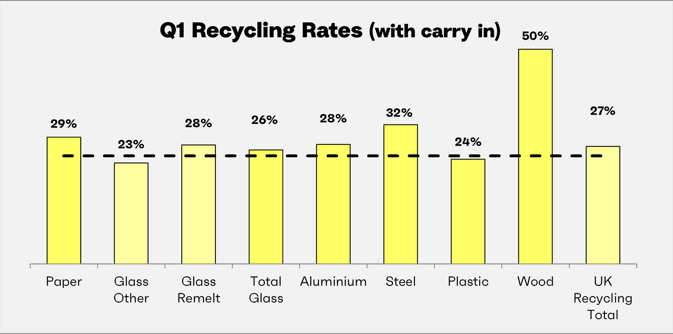

Figure 1.2: Q1 2023 unverified packaging recycling levels with carry over PRNs from December 2022 included.

Paper – Paper appears to have started the year strong with over 1,000,000t of packaging recycled, meaning that it is currently sitting at 28% of the overall estimated target without carry in included. This shows a better start the year for Paper, compared to last year, and is more in line with how it historically performs at this early stage in the year. The UK has historically relied on Paper, amongst others, to have surplus PRNs available come year end to help the UK fulfil its extra ‘General Recycling’ obligation.

Glass – This is the material that continues to be the focus, as it has experienced price rises in recent weeks. Looking back through the last few years Q1 data, it shows Glass has usually tracked lighter in Q1 than the following quarters, which is encouraging as it shows that recycling rates tend to pick up throughout the year. Glass Remelt rates are currently strong and on target without factoring carry in, however as with last year, remelt looks to be making up for shortfall in Glass Other. Glass Other appears to be performing better than Q1 last year, but is still short of its own estimated target, which leaves overall Glass at about 25% at the quarter year mark.

Aluminium – Aluminium surpassed 40,000t recycled, which is bigger than any quarter seen throughout 2022. PRN prices have risen to as much as £200 recently, however the data recorded suggests that these price rises are likely not caused by a lack of recycling. It remains a material to watch, as hopefully these strong recycling rates could encourage price reductions in the near future, especially if UK obligation were to drop as well.

Steel – Steel has surpassed is quarterly estimated target without carry in being considered, sitting at 27%. Pressure in the PRN market may well drop on the back of the figures and along with Aluminium, Steel remains one to watch closely after a seemingly positive start to the year. This data release also indicates that, of the PRNs available, there is still a significant amount yet to be issued, which also holds potential to release pressure from the Steel PRN market as well.

Plastic – Along with Glass Other, Plastic is the only material to remain behind target at the Q1 stage, even with carry in included. When delving deeper into the data release however, it appears that there still quite a few plastic reprocessors/exporters yet to submit their data, which could increase the current figure and improve progress. The Plastic PRN market for this year will depend largely on the UK obligation when released. If obligation drops, it could improve the position we are seeing here today, and hopefully ease market pressure as well. However, no drop or increases, could add more pressure into a market with prices that are so far sustained above £300. Even with any potential growth and obligation reduction, it looks as though it may well be a tight year for Plastic in 2023 with 3 more strong quarters required if the UK is to reach it’s target again.

Wood – Wood has continued its impressive recycling performance from last year with Q1 levels already sitting at 47% of the estimated target. This is encouraging as historically Wood has managed to meet its own specific recycling target, with surplus available to help support the UK’s general recycling target as well. This surplus will likely be required again this year, along with support from other high performing materials like Paper, if current recycling rates are to continue in 2023.

Summary

With the carry in PRNs from December last year being significantly lower than in previous years, it has meant that we have started the year with early high pressure on all materials. The UK needed to hit the ground running this year to ensure it reaches its end of year targets, and as a result, prices have remained high since the start of the year and throughout Q1.

The Q1 data appears to be strong with the majority of materials either looking on track, or surpassing where we would expect them to be at this stage. This is a good start, however, the true position of the UK’s recycling progress is still unclear, as we don’t yet have the initial UK obligation confirmed by the Environment Agency to track against. These figures are very important as they will effectively set the ‘demand’ for PRNs in 2023. As well as this, it will be important to weigh up these figures against the confirmed decreased available carry in for this year, as well as the progress made with so far with supply, as seen in this Q1 data.

One reason the UK may have achieved its current progress is due to the high PRN prices experienced so far this year. When PRN prices are high, the system is designed to stimulate recycling levels, which may be the case with this current data. Even if UK obligation drops, there is no doubt that reaching all targets, and therefore compliance, will be tough. However, it’s encouraging to know that the PRN system can sustain high pressures as seen in 2022, and hopefully this will ease in 2023 if recycling rates remain high and demand continues to be clear and manageable.

We plan to look at the verified data, as well as the all-important UK obligation and PRN market and pricing as usual in our upcoming PRN Market Update webinar, which we are running on 15th of May at 10am. You can register for your free place here.

If you have any questions at all, please don’t hesitate to get in touch with your account manager or the packaging team and we’ll be happy to help.