Q4 2023 Verified Packaging Recycling Data Released

Last week, DEFRA released the final set of quarterly packaging recycling information for the 2023 compliance year. DEFRA also shared final recycling volumes for the year and how this measures up against final obligation, the data detailing how many PRNs that have been ‘carried in’ to 2024, to help the UK reach this year’s targets.

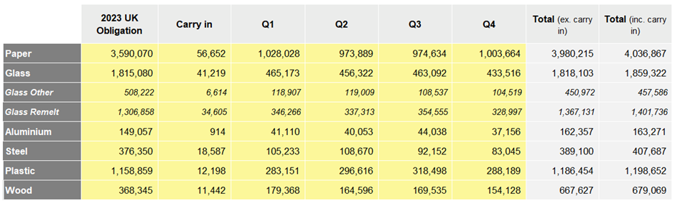

Table 1: UK packaging recycling volumes and UK obligation for the 2023 compliance year

Table 1: UK packaging recycling volumes and UK obligation for the 2023 compliance year

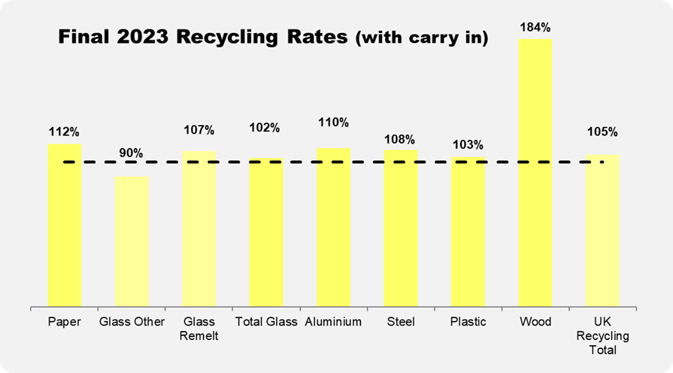

Figure 1: UK packaging recycling percentages versus total UK obligation

The data formally confirms that the UK once again achieved all of its recycling targets in 2023. The total glass recycling target was achieved, but glass other (or glass aggregate) recycling rates fell below the required volume, meaning surplus glass remelt PRNs were required to reach overall requirements, as they were in 2022. All other materials achieved more than required volumes, with the highest performing materials, mainly wood, also contributing to fulfilling the UK’s ‘General Recycling’ obligation, which can be achieved through purchase of any material PRN.

It’s likely that sustained high PRN prices, particularly in the first half of 2023, fuelled the required packaging recycling rates, ensuring 2023 recycling targets have been reached, during a year in which available carry in was significantly reduced, due to the turbulent close to 2022.

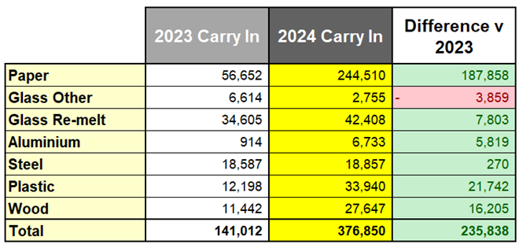

Table 2: Confirmed ‘carry in’ PRN’s available in the 2024 compliance year.

This year’s available carry in has now also been confirmed by DEFRA, with table 2 detailing the amount of PRNs generated in December 2023, which were surplus to requirement and subsequently accepted into the 2024 compliance year. Nearly all materials have shown an increase in carry in available for this year when compared to last, which was a particularly poor year. Only glass other has reduced, likely due to it’s poor recycling performance in 2023, but again increases in glass remelt appear to offset this reduction, leaving glass in a similar situation to early 2022.

The stronger figures were widely expected by many stakeholders and therefore have already likely exerted influence within PRN markets in Q1 2024, with prices and market pressure so far remaining relatively stable.

Attention now turns to several key data releases coming soon, which will shape PRN markets and prices, at least for the near future. The Q1 2024 packaging recycling data (released 22nd April) will be significant in outlining PRN supply levels and availability, followed closely by the initial release of UK obligation data (15th May), which will help detail the UK’s demand. Together, they will provide the first benchmark of how the UK is performing relative to its potential requirements.

Summary

The PRN system has once again delivered compliance to the UK and early indications are that 2024 has begun on a positive note, with increased carry in available already pushing the UK towards its targets.

It’s still very early in the year however, and key upcoming data release holds the potential to encourage or disrupt the relative stability in current PRN markets.

Beyondly Members

Beyondly will soon be running another edition of our PRN market update webinar, in which we will examine all key data sets, outline potential impacts to the market, as well as outlining estimates of our Q3 PRN prices.

If you ever would like to review anything PRN related in the meantime, please do navigate to the ‘PRN Centre’ of the member log in area, where you can find update monthly communications, quarterly pricing updates and slides and recordings from previous webinars as well.